Whether you are a business owner or you have worked in finance, you are likely familiar with filing IRS 1099 forms. But with tax season only happening once a year, gathering the information that you need to file these forms can be a bit overwhelming. This article is designed to give you most of the information that you need in one place to hopefully make this process a little easier for you.

What’s New in 2020?

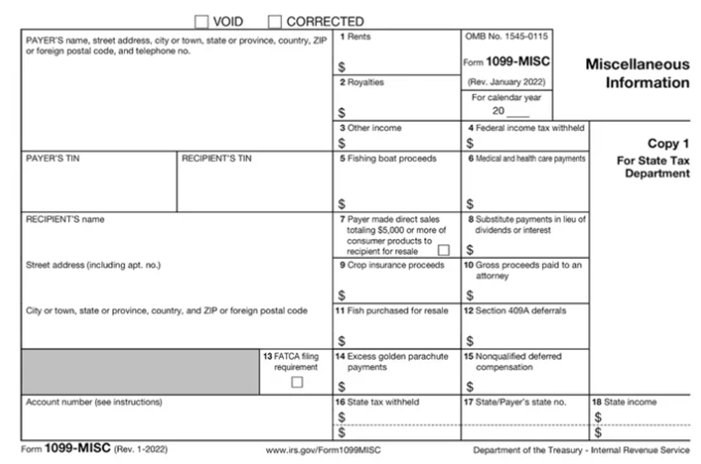

In past years, non-employee compensation would be included under box 7 of the 1099-MISC form. This year, any non-employee compensation will instead be recorded on a separate form called 1099-NEC.

Because box 7 was removed from the 1099-MISC form, there will be a few other changes to box numbers for this form as shown below:

- Box 9 – Crop insurance proceeds

- Box 10 – Gross proceeds to an attorney

- Box 12 – Section 409A deferrals

- Box 14 – Nonqualified deferred compensation income

- Box 15, 16, & 17 – State taxes withheld, state identification number, and amount of income earned in state, respectively

What You Need to Know

Form 1099-Misc

This form should be filed for each person whom you paid either at least $10 in royalties or broker payments in lieu of dividends or tax exempt interest; or at least $600 during the year for the following:

- Rents

- Prizes and awards

- Other income payments

- Medical and healthcare payments

- Crop insurance proceeds

- Cash paid from a notional principal contract to an individual, partnership or estate

- Payments to an attorney

- Fishing boat proceeds

The 1099-Misc form must be furnished to the payee by 2/1/2021. If you are paper filing, it must be filed with the IRS by 3/1/2021. If you are e-filing, it must be filed with the IRS by 3/31/2021.

Form 1099-NEC

This form should be filed for each person in the course of your business to whom you paid during the year at least $600 in the following:

- Services performed by someone who is not your employee (including parts and materials) – Box 1

- Cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish – Box 1

- Payments to an attorney – Box 1

You must also file form 1099-NEC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment. This is recorded in box 4.

The 1099-NEC form must be furnished to the payee AND filed with the IRS by 2/1/2021.

Other Common 1099 Forms

- 1099-A – Acquisition or Abandonment of Secured Property

- 1099-C – Cancellation of Debt (issued by the creditor)

- 1099-S – Proceeds from real estate transactions

- 1099-K – Merchant Card and Third Party Network Payments

- 1099-B – Proceeds from Broker and Barter Exchange transactions

- 1099-DIV – Dividends and Distributions

- 1099-R – Distributions from Pensions, Annuities, IRA, Insurance contracts

- 1099-Q – Distributions from Qualified Education Programs (i.e. 529)

- 1099-G – Certain Government Payments (i.e. state income tax refunds)

- 1099-OID – Original Issue Discount

- 1099-PATR – Taxable Distributions from cooperatives

It is important to note that there are some common causes of confusion with Forms 1099-B, 1099-K, and 1099-DIV. The 1099-B form is not applicable to barter transactions between two business owners and this form is issued by the exchange or brokerage firm. The 1099-K form comes from the merchant service company. For this reason, we do not include vendor payments made by credit cards on the 1099-Misc form. The 1099-DIV form is not intended to report distributions paid by S-Corps or Partnerships. It also does not cover interest labeled as dividends (i.e. a credit union account paying interest on deposit accounts). It is most commonly used to record investments paying cash dividends that are not part of a regulated fund.

Form 1099 Exemptions

You do not need to file a 1099 form for any of the following expenses:

- Payments made to corporations

- Wages paid to employees

- Expenses with receipts

- Payments to tax exempt organizations

Non-Compliant Subcontractors

If you are unable to obtain a W9 form from a subcontractor, the IRS recommends that you follow these steps:

- First request for W9 must be made by 12/31/2020

- File the 1099 leaving the EIN/SSN box blank (you may need to file on paper)

- When mismatch notice is received from the IRS, forward to subcontractor along with back up withholding notice.

What if you miss the filing deadline?

For businesses with gross receipts over $5 million, the penalties for late filing are highlighted below:

- $50/return within 30 days ($565,000 maximum)

- $110/return through 8/1/21 ($1,696,000 maximum)

- $280/return after 8/1/21 or not at all ($3,392,000 maximum)

- $560/return for intentional disregard (no limitations)

Penalties for businesses with gross receipts under $5 million:

- $50/return within 30 days ($197,500 maximum)

- $110/return through 8/1/21 ($565,000 maximum)

- $270/return after 8/1/21 or not at all ($1,130,500 maximum)

- $560/return for intentional disregard (no limitations)

Common E-Filing services

How We Can Help

As filing 1099s can be time consuming, our team at All in One Accounting are happy to assist in this process so that you can continue to focus on making sure your business is running smoothly and efficiently.

We follow a simple process to make sure that the 1099 forms are accurate and filed on time as outlined below:

- Extract data from the accounting system by pulling a 1099 report/vendor transaction list

- Identify those paid more than $600 ($10) in total for the year

- Verify or obtain copies of W9s

- Enter data into e-filing system

- Save forms in our system

Below are the following 1099 forms that we prepare:

- 1099-NEC

- 1099-MISC

- 1099-INT

Click here for more information on 1099s and how we can help your business.

At All In One Accounting, we take businesses from financial chaos to business clarity and beyond. Our elite team of Accountants, Controllers and CFOs are ready to help you in these uncertain times. Visit our website here for a free consultation with one of our accounting professionals.

Follow On Facebook | Learn More About All In One Accounting | Contact Us